Emini Day Trading Lessons: +15 Points – Trading Before and After FOMC Minutes

I think the title says it all today as the FOMC Meeting Minutes news release treated us extremely well. FOMC days are always special in the markets as we need to be extra careful at times but they can also bring a lot of volatility which is a trader's best friend.

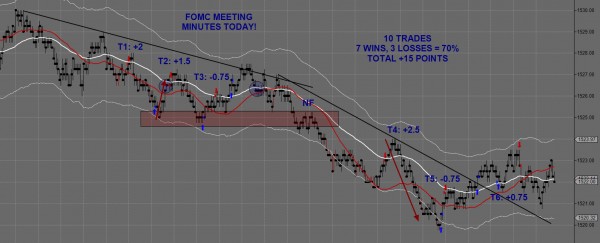

Looking at the two charts below (click to enlarge) you can see a very different market type between earlier in the day and after release and we need to trade each appropriately. I took a conservative approach to my earlier trading by taking some smaller wins and losses and then once volatility came in I adapted and looked for bigger trades.

That's the key to day trading - you need to know how to adapt your targets and risk to the current market environment.

Trade 1

Just a straight-forward short off the open for a couple of points. Sometimes on FOMC day we don't get good movement prior to release but this trade right off the start essentially gave me a "green light" to trade as normal for the morning.

Trade 2

After a quick move to the upside I decided to wait to see if price would hold before going short. It did and I took the trade but due to the lack of general momentum I took a bit less than my planned 2 points when price stalled at the prior lows.

Trade 3

I had hoped here for a break of the lows and potentially a big run but it didn't materialize. I reduced my risk from five ticks to just a few and got taken out.

NF (No Fill)

I attempted a very aggressive short here on the break but unfortunately didn't get filled. This is a more aggressive and risky trade than I normally take but I liked the overall picture of the market and the downward momentum I was seeing so I tried to get in. Oh well, you can't catch them all.

Trade 4

A close call after a deeper retracement that almost took me out for a full loss. That one tick saved me though and the overall bearish market took over again and gave me a nice run. I changed my target to 5 points and started to trail the market tightly or look for a good reason to exit the trade. The bounce off 1520 was strong and my stop was taken out for 2.5 points.

Trade 5

This run up was stronger than I would have liked but I didn't get my order out of the market in time. Once I was filled it seemed well worth holding looking at the overall context of the market but after failing to push lower on multiple attempts my stop was taken out.

Trade 6

The failure of the last trade opened up a somewhat risky long opportunity. The key here is knowing that you need to be extra conservative while fighting the greater market forces. Once we topped out a couple of times the likelihood of any further upside before a deeper retracement was very low so I took a manual exit.

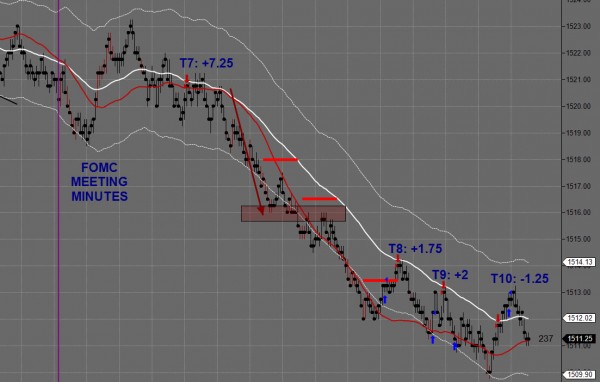

Trade 7

The FOMC Meeting Minutes were released and it was a matter of waiting for the initial chop to work its way through the market so we could find a direction. No real surprises here as the market eventually chose to continue the downtrend for the day. This is where things get interesting. The FOMC Meeting Minutes is a big release much of the time so once the market makes its choice it's very likely to make an excellent move for us. As soon as I saw some good downside movement to the downside I changed my target to 5 points. I cam within a tick of hitting that and the momentum was so good I moved much further and decided to just trail as tightly as I could. You can see with the red lines where I moved my stop during the run before eventually getting taken out for 7.25 points. When you average loss is only about 3 ticks it's quite the haul to bring in 29 on a single trade!

Trade 8

You've got to trade the trend until it ends, right? So right back in but seeing momentum starting to slow I got taken out on what was probably too tight a trail.

Trade 9

Back to 2 point targets as we are starting to look like our run is coming to an end.

Trade 10

One final trade was taken which probably could have been avoided due to specific bullish signs in the market but I wanted to keep pushing until the end. This loss was a good sign that the fun was over and it was time to call it a day. We actually did continue the move down a bit later where more good trades were available but who can complain about such a great day?

- Strike While The Iron is Hot - March 1, 2021

- The Path to Becoming a Full Time Trader - February 22, 2021

- Looking to 2021 and Beyond - January 20, 2021