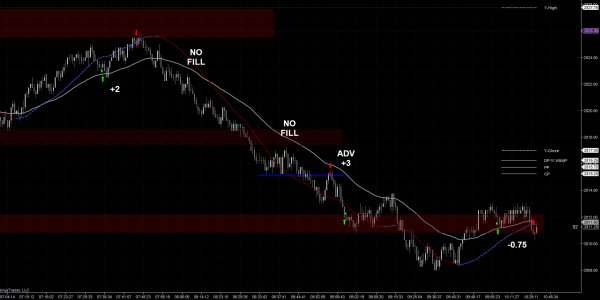

Emini Day Trading Lessons: +4.25 Points – The Value of Knowing Your Price

You can never fully know what to expect out of an FOMC (Federal Open Market Committee) news day but they do have a few somewhat predictable behaviors. In most cases the market doesn't really get a major shock out of these releases as interest rate changes are generally expected well in advance and most things will be priced in, although there could always be some shifts if the language in their statement becomes more dovish or hawkish. As I type this the interest rate decision and statement are still upcoming at 2PM EST but the trading day had some quality opportunities so it's a good place to wrap up in front of the news.

When I mentioned how the FOMC seems to affect market behaviour, what I've noticed is that it's not unusual for the day before the FOMC releases to actually act like a more typical news day (where price moves slowly or ranges as if waiting for release). On the release day itself things actually seem to move quite a bit better and the swings are often larger and smoother. What this means to me is that I typically am a bit cautious the day before the FOMC, in particular about the possibility of trend continuations, but I'm a bit more willing to look for and hold longer runs on the release day itself.

Evaluating My Trading Performance

There's nothing really special about the way I traded today but I'm happy with the outcome. As always, I gauge my performance less on how many points were gained or loss but rather on how well I stuck to my plan and kept emotional control throughout the trading day to make objective decisions. The market was moving well and the swings were good so I just kept things simple and didn't really try to over-think it by fighting the flows.

I followed my plan well and took trades that fit my methodology while managing them objectively, so that's a winning trading day from my perspective no matter what the point total was. I know if I can do that each and every day the my edge will play out in my favor over time so there's not much reason to concern myself with short-term outcomes.

You might notice that I had a couple of "No Fill" situations today where I had wanted to enter a trade but I wasn't able to get my fill at my desired price. This can be a little frustrating particularly when the market takes off in your intended trading direction without you like it did today, but it's a reality of trading sometimes if you are using limit orders to get your price.

Knowing Your Price is an Advantage

I often get asked why I don't just use market orders to enter positions so that I don't miss out but the truth of it is that I don't really want to get in at all unless I can do so at my desired price. Using limit orders this way allows me to have a solidly structured plan which is repeatable with known stops, targets, and management. If using market orders there's the risk of slippage or even just an "itchy" trigger finger that causes you to get into a position too early and in those scenarios it can be much more difficult to keep tight stops.

The other alternative is that I could choose to be even more aggressive with my limit order entries to essentially chase price which would allow me to get into these moves with more certainty. This approach is definitely appealing when looking at today's chart as I probably could have taken another 5 or 6 points but it's also a very dangerous standard to set.

On a day like this with smooth moves things would have worked out nicely if taking more aggressive entries but the market doesn't always operate this way. For every day where the market takes off and doesn't look back there's numerous days where it moves in larger waves and a very aggressive trader would have to suffer a lot of drawdown or a number of losses before price moved in his or her direction.

I ultimately don't really care if I get into every swing or not. All I care about is that I can trade a known edge and follow a structured plan day after day, so that's what I do. I don't concern myself with trying to find a way to capture every point as it's not necessary for consistency or profitability. When I see moves like this that go without me I just think in terms of large sample sizes of similar scenarios where many will go my way and I know that if I keep to my plan that more often than not it will work out in my favor.

A Big Picture Mindset is Key

Having that focus on the bigger picture and larger sample sizes of setups and trades isn't always easy but it's a big part of what I believe separates those who are consistent from those that are not. The novice or inconsistent trader sees every loss as a personal failure and spends considerable time and effort trying to keep it from happening again. That same trader would probably miss a couple trades like this and then either try to adapt their system to catch these next time (which probably won't play out exactly the way it did here resulting in losses) or they will even look to hop to a completely new system that would have taken full advantage of the day. Of course, when a day in the near future plays out poorly they will hop to a new system again and never find a consistent edge. Rinse and repeat.

An experienced trader usually doesn't really care whether they lose a trade, miss a fill, or even have a losing day. It happens. They're not thinking in terms of the outcome of just a few trading scenarios and stressing over the short-term. They are thinking about where their trading edge takes them after dozens or even hundreds of trades. They have confidence in their methodology and know where it will bring them if they simply follow it. When thinking this way, what's the use in getting emotional over a couple setups that didn't quite get filled?

- Strike While The Iron is Hot - March 1, 2021

- The Path to Becoming a Full Time Trader - February 22, 2021

- Looking to 2021 and Beyond - January 20, 2021

Hey Cody, I would like to ask you what is the maximum number of contracts one can trade consistently using limit orders in ES’s market depth.

Hi Dim.

To be completely honest, I’m not really sure what the maximum would be. Right now in the summer with lower volumes the maximum threshold would be lower than at other times of the year or during highly active, volatile periods so anyone trying to trade the “maximum” size would be adjusting accordingly throughout the year. Many traders I know do adjust their sizing for market conditions or based on recent performance but this is usually within a defined range that they are comfortable with and within their risk tolerance so they’re not really pushing to take on the biggest position possible.

Most traders wouldn’t be anywhere close to what the Emini S&P 500 (ES) market could handle however, even if they are well-established retail professionals. The market is simply so large with such high volumes that unless a trader is taking on hundreds of contracts at a time they’re unlikely to see too many issues and even slippage will typically be relatively minor on market orders.

My experience and that of others I’ve worked with suggests that limit orders up to 50 contracts tend to be filled nearly as reliably as orders of 5 contracts. Usually you either get filled or you don’t. I have had experiences though where I might be looking to get filled on 20 contracts, for example, but only 8 of them actually fill in smaller chunks before price moves on into profit and then rest is left unfilled (and then cancelled manually). This doesn’t seem to happen all that often though as I mentioned before because we usually are targeting entry at or before areas of larger volume and order flow so generally price will slip through for a complete fill or not at all.

As for using >50 contracts in your limit orders, I can’t really say. I do know of traders who take on positions that are that size or far, far larger but they often accumulate or distribute over time in smaller pieces or will add on as price returns to favorable levels. Usually when traders get to that level the focus is less on maximising profits and more minimising risk, so the question typically asked is how do I keep drawdown to a minimum as opposed to how can I trade with maximum size immediately for maximum return.

“The novice or inconsistent trader sees every loss as a personal failure and spends considerable time and effort trying to keep it from happening again.”

That is prob a top two thing I struggle with. My ego gets in the way so much that I almost have a need to be right….and being wrong is so “painful” even in sim that at times it prevents me from taking good setups or even worst..moving my stop which leads to an even bigger drawdown. What’s worst is if I take a bigger loss from the moved stop…it’ll get into my head and I’ll miss trades on subsequent good set ups that would’ve resulted in positive expectancy. If I had just tightened up my stop or just let price hit the initial stop instead of moving it then take trades on the subsequent set ups instead of letting fear of being wrong or loss take me out…it would’ve worked out.

We all struggle with it to some degree, Ray. No matter how long you do this the Good Ol’ Ego is still there in the back of your mind searching for perfection, wanting to be right, and trying to avoid facing the reality of occasionally being wrong.

This is why early on I like to take a more mechanical approach to a methodology for developing traders as it essentially forces them to have patience and discipline by sticking to the rules. When you do that you force yourself outside your comfort zone as you need to sit on your hands and wait things out but after you go through that a number of times and see your edge play out over time you realise that what was once an emotionally turbulent event (setup, entry or management) really isn’t the kind of situation where you should be having that kind of response.

From there it not only allows the possibility to be consistent in terms of sticking to your plan, with your decisions in regard to trade and risk management, and in terms of actual profitability, but it also opens up the next stage where a trader can now look to trade with more discretion and in a more intuitive way. Where that would have been a problem early on as decisions and judgements were clouded by emotion, the now more disciplined and patient trader can take more objective decisions based on their pattern recognition and market knowledge that allows further profitability overall.

It’s all a process and like I said earlier some of that stuff never really goes away and you will need to keep aware of it and working on it to improve but it does become much, much easier with experience and regular periods of introspection and review.