Emini Day Trading Lessons: +6.75 – Thoughts on Trader Intuition

I wouldn't exactly say things were quiet on the news front last night but if you were just watching the Emini S&P 500 (ES) today you probably wouldn't have noticed things acting much different. I suppose that's because the market has already priced in some of the current and upcoming political uncertainty. So it's just business as usual then.

Still, there was some good trading and it was certainly a bit more lively than yesterday's very quiet morning. For the most part today was just about taking advantage of momentum swings. Not every day is quite so straight-forward but it's nice to have a day like this where you can just keep things simple and pull out some easy points.

Developing Trader Intuition

Aside from simply sharing charts and discussing the trading process I've also thought this journal could be a good place to touch on a few other things related to the trading world that are sometimes on my mind as well. I've spent a lot of time recently thinking about the concept of "intuitive trading" and that's at least a part of what this trading journal is about for me.

Charles Faulkner, a practitioner of Neuro-Linguistic Programming (NLP) and also a trader, thinks that keeping a trading journal and documenting thoughts, feelings, ideas and insights throughout the day is a crucial part of the process to developing natural, intuitive trading skill.

As he says, prediction in hindsight is a common cognitive illusion so unless you're really documenting things at the time to see where your "leaps" in thinking take you then you're not always going to take the right lessons from your trading actions and results.

In addition to this journal that essentially wraps up my trading day with a few moments of reflection I have also kept a log over the years with notes on my internal thought-process, any emotional responses throughout the day (particularly when managing trades) and other elements or possible insights that have affected my trading process.

I think doing this over time has improved my market edge and allows me to exploit certain market opportunities I might have missed out on years ago.

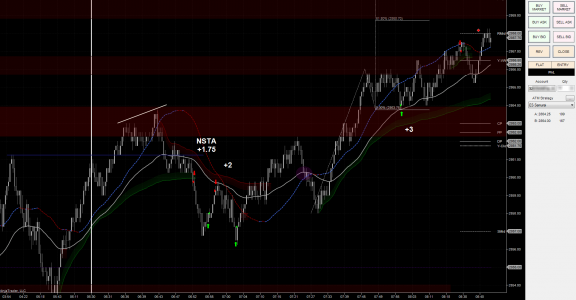

For example, you'll occasionally see trades on my charts that are marked as being Non-STA or NSTA. These are typically trades that don't fit my core Samurai methodology (which are the more common and highly repeatable setups that make up the bulk of my trading) but are instead trades that are more contextual or intuitive in nature.

I'm often hesitant to share some of these charts and trades as I know they can be difficult for others to replicate, at least initially. However, given enough screen time to develop pattern recognition and to build confidence in their trading skills I do believe it's possible for most people to trade in an intuitive manner successfully.

Best of Both Worlds

That said, I still find that works best for me is a combination of approaches. I prefer to keep the majority of my trades and the foundation of my edge in something that is easy to repeat, fairly simple to apply, and can have a very structured plan around it (which is what I teach as well). I want to be able to identify my setups well in advance of when they will happen and plan out my stops and possible profit targets before I put a dollar at risk.

With more intuitive trading that isn't always possible as there's something impulsive to it and it requires acknowledging feelings or cues that we don't always fully understand at the time. It's still critical to set limits on your risk and to make sure those trades fit within the structure of the rest of your trading plan, but sometimes it's important to know when to give yourself a bit of wiggle room to take advantage of what the market has on offer.

As Ed Seykota said when talking about his key trading rules in Market Wizards, "follow the rules without question... and know when to break the rules". I think he just might be on to something. Perhaps that could be worth exploring a bit further in future Journals.

- Strike While The Iron is Hot - March 1, 2021

- The Path to Becoming a Full Time Trader - February 22, 2021

- Looking to 2021 and Beyond - January 20, 2021

Hi Cody.

Thanks for these recaps!

I was wondering why you didnt take the trade with the purple ball, because on august 8 you also had a purple ball at a possible long between the first and second trade, about which you said you would have probably taken it, if it would have pushed a bit further so that it could use the previous swing high which it barely surpassed as support. In this case the price did surpas that swing high and was able to use it as support, so i was a little curious as to why you didnt take that trade. Could it be because it was close to that bigger support level (the red bar)?

Thanks so much!

Hi Eric.

When I mark those areas with a circle it’s cases where there has been a structural shift but no valid setup. Essentially, it’s a scenario where there’s a potential shift but no valid trade as the move didn’t fit the rules of my trading plan. I have a handful of criteria I’m looking to have fulfilled for a valid setup and this situation is missing a couple of them, the most obvious being limited momentum relative to prior moves.

For the later long that wasn’t an issue as it fit all of the criteria of my trading plan so I took the trade.