Emini Day Trading Lessons: +5.25 Points – It’s Not About Taking Every Tick

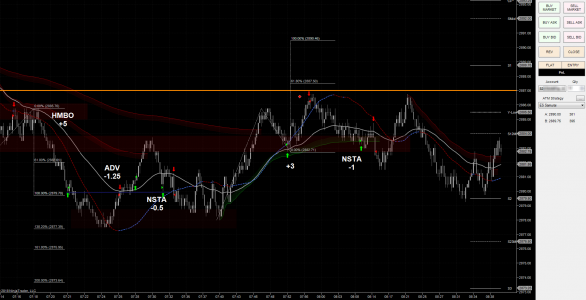

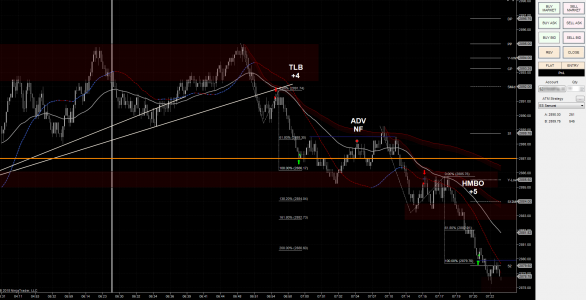

Today was all about targets. I was only "right" half the time but it didn't matter. I targeted my trades well.

In these Journal posts I've been talking about adaptability quite a bit recently and today was a case where the adaptable trader should have taken full advantage. Swings were large, momentum was high and opening up profit targets to look for more distant areas made sense.

Hitting Singles and Doubles

The problem some traders have is that they look for these home run trades all the time. You can still be profitable that way, particularly as a long-term position trader, but as a day trader it's going to be difficult to be consistent.

Some days go sideways or have small waves of movement so it's difficult to look for large profit targets. Some days are more erratic and even if the swings are large they might not be reacting well to known technical levels. However, if you're getting a day where the market is reacting cleanly and price is clearly making good runs then it's important to be ready to adapt to take full advantage.

There's nothing particularly special about what I'm doing here. I'm trading with low risk from areas where I expect order flow in my favor, ideally due to a supply and demand imbalance. Because I'm taking setups in these locations rather than on every pullback in the chart I can generally expect bigger moves to develop and a better reward to risk ratio.

If I get exceptional moves that break the market structure then I'm going to look for exceptional targets, generally either a Fibonacci extension when price is moving into "space" in the chart or a key level. An example of such a level would be 2887 (take a look on your daily chart to see why) which I used for trades and targets all session.

Not About Catching Every Tick

I didn't really maximise my results either but it doesn't matter to me. I could have had more points in both of the major runs down but I simply followed my plan. I'm not going to worry much about missing out on a point or two as I know how often those areas can snap back and take that profit away. After all, it's only a theoretical profit until it's realised by exiting the trade.

So while I do want to take a good chunk of each move if it's available I'm never really going to worry about taking every tick. It's better to be profitable than perfect.

That's a good lesson for all the Holy Grail seekers and system hoppers out there but the truth is that it's a continual lesson for me as well. I tell myself regularly that it's better to be profitable than perfect so I don't lead myself astray.

It's natural to want to find a way to take points from every move and never miss an opportunity but that's not the reality of trading. Instead, I just focus on the setups that fit my plan and known trading edge, adapt my management to the market, and let the numbers play out. It might be a bit less exciting than catching a move perfectly but it's also considerably more effective.

- Strike While The Iron is Hot - March 1, 2021

- The Path to Becoming a Full Time Trader - February 22, 2021

- Looking to 2021 and Beyond - January 20, 2021

“Better to be profitable than to be perfect” – I think that hit home for me.

For sure! Like I said in the article, it’s something I repeat to myself often because like many traders I fell into the trap of trying to do everything perfectly many years ago. I didn’t want to take losses, didn’t want to miss any major moves, etc. This led to me curve-fitting strategies at times, over-trading, or trying to find new systems that would fix all these “problems” I was seeing in my trading. Eventually I realised that those issues weren’t really a problem at all because as long as I stuck to specific tested trading scenarios where I had a known edge then that’s all that mattered. I didn’t need to find a way to trade everything or manage all moves perfectly to be highly profitable. That was effectively the turning point for me in terms of making trading a career.