Emini Day Trading Lessons: 16 Points – Opportunity, Volatility and the Non-Farm Report

This week can be summed up in one word - challenging. It's not that there wasn't profit to be had. In fact, some of the STA traders had big 15+ point weeks and broke their personal record for their most profitable single day so far. So while there was major profit potential what made it difficult was the shifting market conditions and keeping the confidence to stick to your trading plan.

Trusting Your Trading Edge and Following the Plan

As traders, it's important to realize that the market will always find ways to test us. No matter how skilled we become at our profession, no matter how profitable, the market will always continue to create compelling situations that tempt us to move away from our trading plan. In order to combat this, we need to be confident in our long term trading edge so that we can maintain our adherence to our trading rules.

This week the market gave us two very difficult trading environments during the morning session. Both Tuesday and Thursday were choppy, limited momentum affairs that made it difficult to find profitable trades. When you are spending time at the screens and are not being fairly rewarded, it can be very tempting to make shifts in your approach to hopefully "just find something" that will pay a decent profit.

As you might guess, these changes to a trading approach during difficult markets rarely pay off. Almost always it simply leads to additional losses, emotional revenge trading, and a downward spiral. We need to remain vigilant at all times because anyone, no matter how experienced, can be susceptible to this tempting trading error.

However, there is another trading demon out there that is perhaps more damaging and certainly better concealed - doubt. New traders are especially troubled by doubt, but market veterans can be susceptible at times as well.

Doubt shows up in a common patterns when looking at a trader's charts. They struggle one day in a difficult market and although the following day is absolutely fantastic, they fail to take advantage. Trades aren't taken, exits are made early, and aggressive entries are taken far too late in dangerous areas when the fear of getting in a trade is finally surpassed by the fear of missing out on a possible winner.

There is no perfect cure for self doubt as a trader, but there's a reliable way to keep it under control. In order to maintain their confidence, all a trader needs to know is that they have a strong trading edge (also known as positive expectancy) to their overall plan. Know your rules, test them extensively, and become fully familiar with your edge.

Once you do, a single losing trade means nothing. Even a string of a few losses won't faze you. A trader who knows his edge and who is confident in his plan will trade without hesitation. He doesn't let the current trading opportunity become clouded by the outcome of the trade that came before. The warrior trader will strategize, observe, and execute when their conditions are met.

"The general who loses a battle makes but few calculations beforehand." Sun Tzu

Day Trading Recap Video

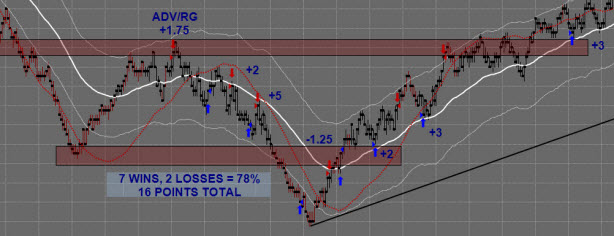

Thanks to the Non-Farm Payroll release and the resulting volatility, Friday was without a doubt the best trading day of the week. Wednesday was an excellent 10+ point day as well, but Friday really opened up with the market moving in large swings, allowing experienced STA traders to adapt their profit targets and fully take advantage of the opportunity.

If you're having trouble getting the video to load, CLICK HERE to view it at YouTube.

As you can see in the video, I didn't trade anywhere close to what would be considered "perfect". I missed the whole run to the downside, I left profit on the table in most trades, and I passed on a couple winning opportunities.

It's important to realize is that in trading, perfection is an illusion.

Every day we make some good decisions and make some that we could improve upon. What matters in the end though is if you followed your plan to the best of your ability and traded in accordance with your tested edge.

By doing that you will have great days, good days, and some bad ones too, but it won't take long for your edge to assert itself, allowing you to achieve the consistent weekly and monthly profitability you desire.

- Strike While The Iron is Hot - March 1, 2021

- The Path to Becoming a Full Time Trader - February 22, 2021

- Looking to 2021 and Beyond - January 20, 2021

Awesome! I love Non-Farm trading and had a great day as well but still 6 points off your total. Still, 10 points is a pretty good haul for one day. Thanks for these great recaps, Cody!

You’re welcome, Mike. Good to hear that you find them useful. Congrats on your 10 point day! Let’s hope that NFP continues to bring some nice action to the market in the days and weeks ahead.