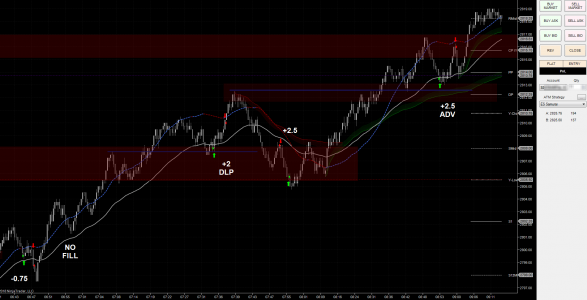

Emini Day Trading Lessons: +6.25 Points – Trading Experience Matters

I might have had a bit of luck on my side today. For the most part I got some good fills, managed to find the right areas for minimal drawdown when the levels were uncertain and took my profits at good locations before major pullbacks. Some might say that luck doesn't really play a part because as traders we're working with a known edge and the probabilities will play themselves out but at least in the short-term over a handful of setups there can be a bit of luck that occurs for things to play out your way.

Sometimes trading can be a very straight-forward affair as setups are clean and simple but that's not always the case. For example, today's market wasn't nearly as easy to trade in real-time as it appears in hindsight and there were plenty of cases where momentum was shifting or price was going into questionable areas of supply/demand.

A Day That Could Go Either Way

Although ideally any two traders sharing a methodology and trading framework will have very similar results, today is probably one of those days where experience really shines through and there will likely be a decent gap in profits between veteran and novice traders.

A trader with a bit of luck (and some skill) on their side will be more likely to fill their positions and if they are willing to take a couple more aggressive setups that will be rewarded as well. Not every day plays out that way however and I do plan on sharing those in this journal as well. Sometimes I know the deck is stacked in my favor but the cards simply don't come out quite right.

On another day I could easily see situations where I might have missed trades two and three as I simply didn't get my orders in quickly enough or because I second-guessed the market reactions for a bit too long. The flip-side of that is that perhaps with a bit more luck on my side I could have had an absolutely fantastic day with an earlier fill on the long that would have gone up 3 or 4 points for me making it a 10+ point day.

Thinking Beyond Short-Term Results

The point I'm trying to make here is one I've made before in previous journals and numerous posts around the site. Simply put, it wouldn't really matter if I missed those trades or took a loss. The odds played out my way today but another day they might not. Over the medium and long-term though I know based on practice and experience that my edge will work out.

If I had an unfortunate run that saw me miss out on most of the good setups today only to take a loss or two I wouldn't have any real regrets or look to change my methods. I traded my plan and took one good trade after another so I traded the day well. I use Mike Bellafiore's definition of a good trade as simply being a trade taken that fits the rules of my plan, not whether it happened to win or lose, so I just focus on stringing good trades together and let things play out as they may.

- Strike While The Iron is Hot - March 1, 2021

- The Path to Becoming a Full Time Trader - February 22, 2021

- Looking to 2021 and Beyond - January 20, 2021